What Is Blockchain, Really?

At its heart, blockchain is a fancy word for a digital ledger—a record book that lives on computers owned by many different people. Every time something is added, it gets locked in a block, stamped with a time, and linked to the one before it. Once a block is sealed up, it’s pretty much set in stone. That’s where the name comes from: blocks, chained together.

But blockchain isn’t just about cryptocurrency. Yes, Bitcoin made it famous, but the tech itself is more versatile. It’s like saying the internet is just for email. In reality, blockchain can run supply chains, track medical records, manage voting systems—you name it. The point is trust. It’s a system that doesn’t need one central authority to say, “this is true”—because the network agrees on it together.

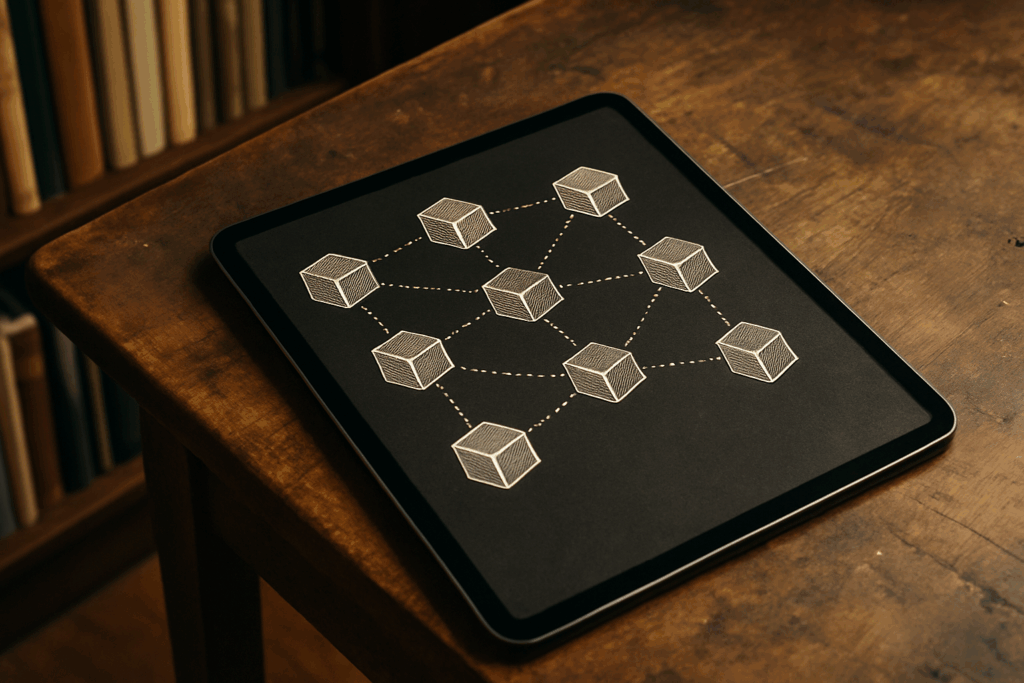

That brings us to decentralization. Unlike a database run by a single company or government, blockchain spreads control across a network. No one party gets full power. If one node (or computer) on the network tries to change something shady, the rest disagree and block it. That structure makes it harder to tamper with and more transparent by design. Instead of asking one person to tell the truth, the truth has to pass a kind of consensus test.

Why should you care? Because the way we share, track, and verify data is changing. Trust, once tied to institutions, can now be programmed directly into technology. And that shift could redraw how industries—and even societies—function.

How It Works (Without the Hype)

At its core, blockchain is a simple structure with a fancy name. Think of it like this: each block is a container that holds a list of transactions. These blocks are connected in a chain, one after another, making it nearly impossible to tamper with earlier records without raising red flags across the network. This setup forms a chronological, immutable ledger.

Nodes—computers spread all over the world—run the blockchain. They verify transactions, keep copies of the ledger, and maintain the system’s integrity. Nobody owns the network outright; that’s the power of decentralization. To agree on what’s real and what’s not, blockchains use consensus mechanisms. The most well-known are Proof of Work (used by Bitcoin) and Proof of Stake. These systems make sure everyone plays fair and no single actor controls the truth.

Now, public vs. private blockchains: public ones are open to everyone—anyone can see the data and participate. Bitcoin and Ethereum are good examples. Private blockchains are more restricted—think of them like intranets for organizations. They offer more control and faster speeds but sacrifice some transparency and decentralization.

One thing that sets blockchain apart is its built-in security. Each block links to the one before it using cryptographic hashes. If someone tries to alter a block, the hash changes, breaking the chain and alerting the network. On top of that, with most versions of the ledger stored on multiple nodes, it’s extremely tough to fake a transaction without everyone noticing. This makes blockchain a fortress for data—with fewer doors to sneak through.

Real-World Use Cases

Blockchain isn’t just about Bitcoin anymore. Industries are starting to plug it into some very real, very practical problems. In supply chains, for example, blockchain offers a tamper-proof log of where things come from, how they move, and who touches them. This means fewer counterfeit goods, tighter controls, and way more trust in global logistics. Healthcare is also leaning in. Patient records stored on a blockchain can be securely shared across hospitals, without the usual paperwork grind. That matters when time is short and stakes are high.

Finance, of course, is the other big one. Beyond just cryptocurrencies, think smart contracts—digital agreements that execute automatically when conditions are met. They cut out middlemen, reduce delays, and limit disputes. Insurance claims, loan approvals, even invoice payments—they all get smoother.

The common denominator? Transparent, trustworthy data with less human error and manual oversight. For more on how this is actually playing out across industries, check out How Blockchain Is Transforming Various Industries.

Benefits Worth Your Attention

Blockchain isn’t just another tech buzzword—it solves real problems, especially when it comes to trust, transparency, and efficiency. Here’s how it brings tangible value:

Trust Without Middlemen

Traditional systems often rely on intermediaries—banks, brokers, notaries—to verify transactions or confirm identities. Blockchain cuts out these middle layers by using a decentralized network of nodes to verify and record data.

- No central authority needed for validation

- Transactions are verified through consensus mechanisms

- Trusted systems without relying on third parties

Data Integrity You Can Prove

One of the most powerful aspects of blockchain is its immutability. Once data is recorded on a blockchain, it’s nearly impossible to alter without detection.

- Each block is cryptographically linked to the next

- Tamper-evident design ensures data authenticity

- Participants can independently verify records

Improved Efficiency and Reduced Friction

Blockchain streamlines processes across industries by automating manual tasks and reducing delays tied to cross-party verification.

- Faster transactions, especially in cross-border payments

- Smart contracts eliminate the need for intermediaries in legal or financial transactions

- Fewer errors and less redundant paperwork

By removing bottlenecks and increasing transparency, blockchain improves the way data and value move through systems—something legacy infrastructures often struggle to keep up with.

Limitations & Misconceptions

Blockchain gets packaged like a miracle. It’s not. At the end of the day, it’s just code—a clever system built around distributed ledgers, cryptography, and consensus protocols. And like any tech, it comes with boundaries.

Let’s get a few myths out of the way. First, anonymity. Blockchain is pseudonymous, not private. If someone links your wallet to your identity, every transaction you’ve ever made is an open book. Second, energy usage. Yes, older chains like Bitcoin eat a ton of power. But newer networks are moving to proof-of-stake and other eco-friendlier alternatives. The problem isn’t solved, but it’s shrinking. Third, unhackability. The tech is sturdy, but the weak points are often human—phishing scams, bad apps, sloppy storage.

Then there’s the bigger picture: regulation and scale. Lawmakers are still figuring out how to approach blockchain, and that uncertainty slows adoption. Plus, trying to scale blockchain for millions of users without bogging down speed or blowing costs? Still an open challenge. So no, blockchain doesn’t fix everything. But that doesn’t mean it’s broken. It just means you have to use it for what it’s actually good at—no more, no less.

Where It’s Headed Next

Blockchain isn’t just a buzzword anymore—it’s being built quietly into the bones of multiple industries. Finance was the first obvious frontier, with major institutions piloting decentralized finance (DeFi) services and blockchain-based settlement systems. Now, supply chains, real estate, energy, and even media are actively exploring how to bake in blockchain for transparency, automation, and better tracking.

Healthcare systems are testing it for patient record management that gives patients more control. Governments are flirting with blockchain registries for things like land titles or digital voting. The pace varies, but one thing’s clear: blockchain isn’t stuck in theory anymore.

Zooming out, its role in Web3 is becoming more defined. We’re talking creator-owned platforms, decentralized social networks, and systems where your digital identity isn’t just a username, but a verified, portable passport across services. Tools like self-sovereign identity (SSI) are making it possible to own your own data wallet, and selectively share what you want, when you want, with full transparency and control.

The bottom line: don’t chase blockchain just because it sounds cool. Use it where it solves a real problem—where trust is broken, data isn’t flowing, or middlemen are bloating the system. Hype fades. Utility sticks.

Melissa Rooneyesters has been instrumental in the growth of Factor Crypto Edge through her dedication to editorial quality and community engagement. By refining content and fostering meaningful connections with readers, she has helped strengthen the platform’s reputation as a go-to hub for crypto enthusiasts and professionals alike.

Melissa Rooneyesters has been instrumental in the growth of Factor Crypto Edge through her dedication to editorial quality and community engagement. By refining content and fostering meaningful connections with readers, she has helped strengthen the platform’s reputation as a go-to hub for crypto enthusiasts and professionals alike.