How Regulatory Shifts Are Reshaping Cryptocurrency Markets This Year

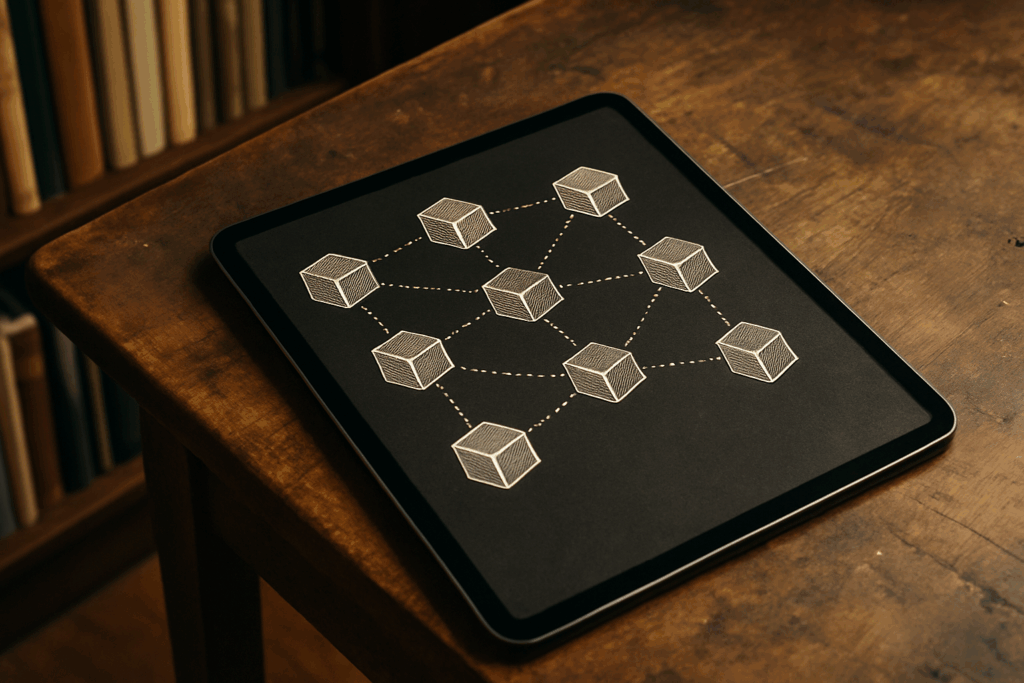

Why Regulation Is the Market Mover in 2024 Crypto’s wild west days are coming to a close. Governments around the world have ramped up regulatory scrutiny, tightening controls on everything from token listings to transaction tracking. What used to be a loosely governed space is starting to look at least on paper more like traditional […]

How Regulatory Shifts Are Reshaping Cryptocurrency Markets This Year Read More »

Melissa Rooneyesters has been instrumental in the growth of Factor Crypto Edge through her dedication to editorial quality and community engagement. By refining content and fostering meaningful connections with readers, she has helped strengthen the platform’s reputation as a go-to hub for crypto enthusiasts and professionals alike.

Melissa Rooneyesters has been instrumental in the growth of Factor Crypto Edge through her dedication to editorial quality and community engagement. By refining content and fostering meaningful connections with readers, she has helped strengthen the platform’s reputation as a go-to hub for crypto enthusiasts and professionals alike.